Wartime

Well if you asked me if we’re were potentially staring down the barrel of world war 3 I would have told you, you might be crazy. Well, here we are. Russia has launched a full-scale invasion of their neighbours Ukraine and they are actively pushing toward the capital of Kyiv. Regardless of your stance, nationality and what you believe, people and innocents are the ones who suffer most during wartime. It’s terrible and my heart and Prayers go out to anyone displaced or affected by this terrible conflict.

Again, I am not at all making light of war and it is a terrible thing, however as this is a personal finance blog. We can look at what this would do on a global level as well as what this could do on a personal level. You might be sitting there, wondering what you could do if something as terrible as war were to hit your country or how it would affect the markets overall. Let’s dive in and explore these questions together.

Wars in the past

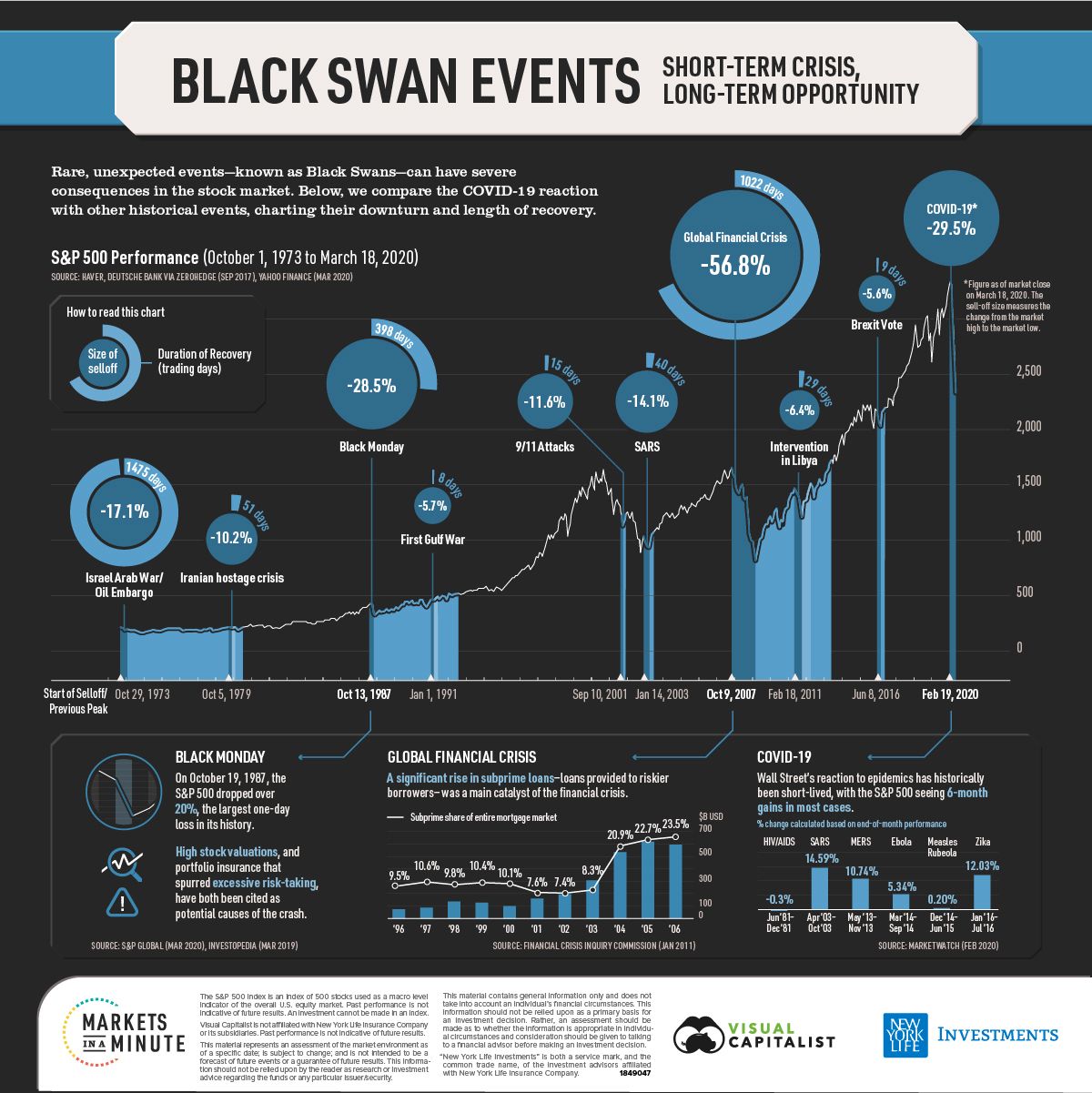

Long time followers and friends know that I am a big believer in index funds and in this post, I go into detail why. That being said, I think that the S&P500 could be considered a great overall market indicator, as it is one of the older indexes and it tends to react to big events like wars as well as global disasters like the coronavirus. Nothing quite illustrates something quite as nicely as a graph. So below is a wonderfully detailed chart, that I've used before, however, this has been updated since the global pandemic.

Now. This graph illustrates how extraordinary events (Black swans) have impacted the S&P 500 since 1973. As the chart states, the inner circle shows the percentage drop and the outer ring indicates how long it took for the market to recover back to to its initial drop (the inner ring). Pretty self-explanatory.

Now with that out of the way, I think it's wise to draw particular attention to a couple of things.

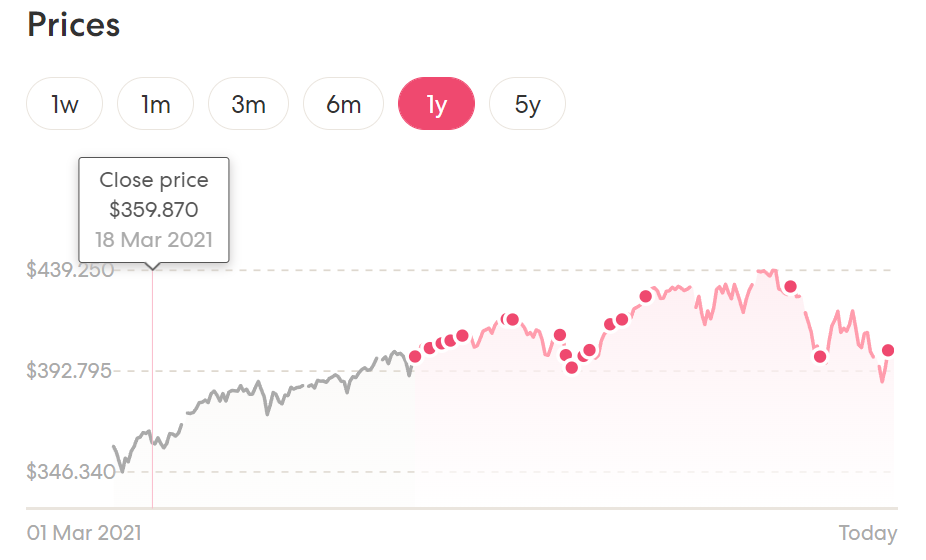

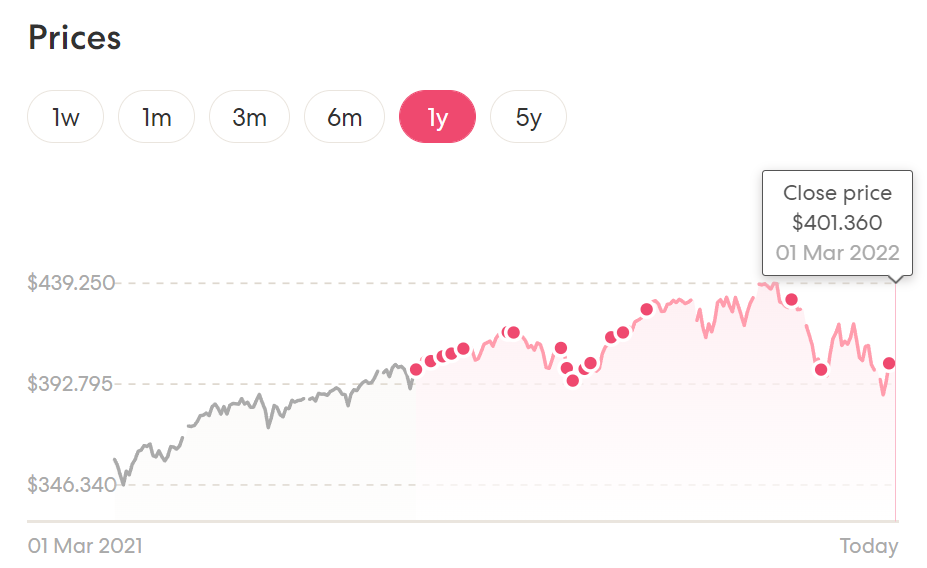

- The data ends in March 2020, arguably the height of the pandemic, since the market has made a wonderful recovery as indicated down below and as of late has dipped a little.

03/18/2020 - Present day

- There has been quite a number of warlike events or crises since 1973, this excludes WW1, WW2 etc.

Now looking at this chart, we can see that from all of the warlike events like the Gulf War, Nato intervention in Libya and then, of course, the Arab Israeli war, one of them namely the Arab Israeli war had the worst effect on the S&P 500 and it took it a whopping 1475 days to recover. In saying that, the Gulf war, as well as the intervention in Libya, took 8 and 29 days respectively. So what are we to do with this data then Milan? Glad you asked. The way I see it, foreign wars and major events do indeed have an impact on the S&P 500 as well as the overall market. At the peak of the pandemic, we can see that the market had been down 29.5% but since it has surpassed all of the losses and the S&P has hit all-time highs. That is the point I am trying to get across. If you have time, then you are in luck. You can sit it out and actually buy shares at a bargain.

What are we doing during all of this?

War as I said a couple of times now is awful, especially modern war. Weapons and technology have become so advanced that a missile could easily take out a block of homes in a single strike. Now that I really have you panicking I would like to encourage you to stay calm. If you have a solid investing plan, dips in the market should excite you. Especially if you have time. Don't know where to start or what to do? Well, I've got a completely free workbook that I teach you exactly how we as a family went from $0 - to six figures in just over three years.

To the rest of you -

We will keep buying and riding the bumpy wave for as long as it lasts.

On a more serious note, I am more than happy to work with you on a personal level and answer any questions to see if I can help from my experience. Please reach by emailing mail@firelife.co.nz

Looking ahead

In the past few years, globally things have looked quite bleak. I want to encourage you that the world would've looked scary from 1914 to 1945. This too shall pass and it is important that we do not get fixated on negatives or the what-ifs. We can only control the things we can control. There is no point in worrying about the things that are completely not in our control. The world and media are fear-inducing enough.

Let's instead encourage each other and help each other. Let's be a helping hand to our neighbours and our friends. Let us draw together and overcome the awfulness and go into the future full of hope.

Every time I write a post, I am humbled to have readers read my work and I am so excited that my work can contribute in some capacity to someone's future happiness.

Stay encouraged folks!

New Readers

As always If you are a new reader, I would love for you to sign up for our newsletter down below. It will also instantly give you access to my guide on personal finance and how you can create that future you've always wanted.