Too much choice

Firstly I would love to thank all my readers of the blog for your support and visiting every month. I really do believe that this blog will help people make wiser decisions when it comes to their money and finances.

Then, my beautiful daughter Mia Mari was born. She is such a joy and a precious little angel sent to be part of our lives. Seriously so cute! Becoming a dad has done a couple of things :

- Made me super grateful for the medical staff in New Zealand. We were treated with the utmost respect and care when it was time to bring the baby into the world.

- I realized that my wife and anyone that has been through labor have essentially been through a war and they deserve to be spoilt.

- I am forever responsible for my daughter and I have to ensure she gets the tools she needs to prosper in life.

It’s still early days in the world of being a dad but I am enjoying it thoroughly. I am currently staring at my beautiful daughter sleeping next to me… not a care in the world.

Today’s topic – why too much choice makes investing risky.

PSA. Everything written on this blog is my opinion and thoughts in real-time. Do your own research but know my theories and ideas stem from well-researched studies and factual information.

That out the way, let’s dig into the meat and potatoes of this post. I see a trend in NZ that both excites and scares me. More people are starting to invest, Sharesies has grown to over 58000 investors.

Those numbers are awesome as more everyday Kiwis are getting into the stock market and they are trying to set themselves up for success.

Why this might be scary

It’s great that people are getting into investing, however, I think that platforms like Sharesies might be setting people up to lose. “How can you say that Milan?” Well, let me tell you why young grasshopper. When Sharesies was brought to market, you were only able to invest in ETFs or exchange-traded funds

At the start of September, they allowed everyone on the platform to invest on the NYSE (Giving everyone access to US-based stocks)

The reason I find this dangerous is that I think people will be gambling more than investing. In my opinion, most people will be investing to try and make a quick buck. I can see a trend forming in the Sharesies Facebook group. People are speculating and making wild bets on companies they know nothing about.

As entertaining as this might be, I really do care for people and their well-being. Having the choice to punt away your hard-earned money on a company you know nothing about doesn’t mean you need to do it.

Instead of me being a grumpy old man yelling at day traders or single stock selectors to “get off my ETF lawn” let’s look at a practical example.

Nikola – This company was valued at Nikola evaluation just a couple of months ago. You would love to think that this company was properly vetted and that everything was in order… right?

Wrong

This company is in shambles after its CEO and founder cut and run with a bit chunk of his shares. That’s right MIA! This scares me. I’ll tell you why. This company managed to go public and have everyday investors like you and me invest in them with the belief they will be delivering on what they promised.

This is at the heart of the free market and works well when it’s done correctly, ie Amazon, Google, Facebook, etc.

The scary part is that this company was evaluated and allowed on the NYSE by “professionals”

So what are we to do then?

Why Investing shouldn’t be scary

I will preach this till the day I die, but ETFs and Index funds are the way to go. Too much choice will cause a lot of inexperienced investors to lose a lot of money or guarantee average returns.

In this post, I clearly show you the returns of the S&P 500 Index fund since its inception. Now if you are a long-time reader you will know that I think everyone should be invested in the S&P 500. I won’t bore you with my personal opinion, however, I will say this, I did my research and had a look at who did it the best. Who was truly the best stock market investor of all time?

I think Warren Buffett will be in any argument top 5 list. In an article by Business insider he had the following to say

A low-cost index fund is the most sensible equity investment for the great majority of investors,

Warren Buffett

With one of the all-time greats recommending a low-cost Index fund like the S&P 500, why is it that so many people are still investing in stocks instead of index funds?

I think people believe they can beat the market average of 9.8% annualized for the S&P 500 over the last 90 years. Well, what does Mr. Buffett have to say about this?

By periodically investing in an index fund, the know-nothing investor can actually out-perform most investment professionals,

Warren Buffett

When I heard this for the first time, it blew my mind as well. This is true. Warren didn’t just merely say this, he put his money where his mouth is.

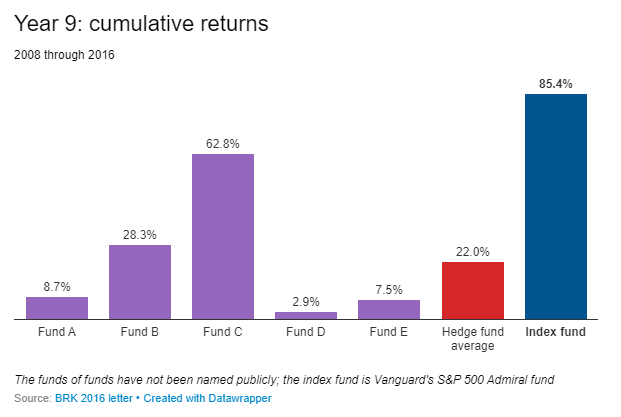

He had a bet with the hedge fund industry in where he challenged Protégé Partners LLC to see who would win. Handpicked hedge funds or the ‘boring’ S&P 500 Index fund.

The results may or may not surprise you :

The total results over the 9 year period clearly shows us that the Index fund outperformed all of the hedge funds. Read the article by Investopedia

Keep it simple – silly

With all of this, I can’t stress this enough. Actively managed funds or stock selection is a terrible idea. Select a couple of index funds and let the market do the work for you.

Do yourself a favor and become a boring investor. It might not be flashy, however, you will win over the long run. The stats back it up across the board.

If you are still not convinced, watch this video on how many day traders actually make enough money to look after their basic needs (click the image) :

That’s going to do it for these last couple of weeks. Sorry for the delay between posts, I have been super busy meeting and spending time with my new daughter. I am sure any new parent can relate.

I will endeavor to have a post out every 3 weeks.

Thats going to to do it for these last couple of weeks. Sorry for the delay between pots, I have been super busy meeting and spending time with my new daughter. I am sure any new parent can relate.

I will endeavor to have a post out every 3 weeks.

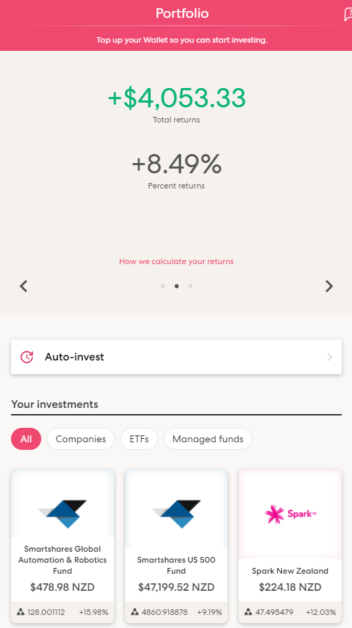

Our Portfolio

No change in terms of what we are invested in. We’ve had to adjust how much we invest slightly due to my wife being on maternity leave. It seems like the market is doing well and we are happy about that!

Another in the books. As always, please send me an email down below so I can help you out.

Stay safe.

MK

Also please sign up for the newsletter if you haven’t already. I will share some helpful tips and thoughts with you every other week.

- Our portfolio.

- Our monthly budget breakdown.

- My monthly book review.

- Investor scenarios, where I share conversations I am having with people around FIRE and investing.

- Future things! I will aim to add more valuable things here in the future.

This also includes our completely free workbook! Where I will show you what I do to invest.