Why budgets aren’t boring

Everyone and their dog has heard that ‘you need a budget’. Often what I’ve seen is that this is only 50% of the equation.

I know people who meticulously budget everything and have every dollar allocated but they aren’t getting ahead in life.

So how then do we solve the problem? Glad you asked( if you did). I have two goals for this post. Number one I’m going to reiterate the value in budgeting and planning and number two I’m going to show you how we’ve done it for a number of years.

Oh and lastly I will reveal a Cool project I’ve been working on.

The purpose of a budget

Alright, medicine upfront. Not knowing where your money goes every month or week when you get paid is a problem. I usually find however people are in limbo. They know they need a budget but they don’t have one.

I would argue the main reason is that people don’t value the outcome of a budget enough to compel them to do one. That or the pain of looking at their spending habits is too much to bear.

The main purpose of a budget is to clearly show you where every dollar you make or spend is going. It’s an important and very necessary tool in the tool belt. You have to be working from one if you are to get control of your finances.

Fight the money gremlins

Well hopefully through this and the many other articles on the blog you now realise that you need a budget. What you might come to find is that there are quite a few money-hungry gremlins looking to eat away at your money.

What I mean is that people spend a lot more than what they think they do. So creating a budget is often a very psychological experience as well as a practical one.

People are confronted with their decisions. Good or bad.

I say it's best to rip the band-aid off and tackle your situation head-on. See what’s eating away at your budget and stop it.

Keep it simple

On one hand, you have to have a budget. That is for certain. On the other, I think some people take it to the extreme. A budget is like a scale. If you’ve worked out that week, your diet has been good. You confidently jump on the scale and you love the results. Budgets are the same way in that you need want to spend time on your budget. You need to want to dive in, look at your numbers and be happy.

Most people don’t have one or they dread their current one. Often though it is because what they have set up is convoluted, messy and complex. To be honest with a lot of software I’ve tried over the past few months, that has been my experience.

I wanted something that shows me what I needed to see at a glance as well as a way for me to track things.

Future thinking or lack thereof

Most budget trackers out there do an adequate job at showing you your numbers and a basic overview of your expenses and income. A massive missing feature for all of us on the road to financial freedom was a way to show our overall net worth and project into the future.

I know some trackers do this, however, I found them to be clunky and not useable after a while. I wanted something simple. Something I can punch in a few numbers and see our entire financial situation.

How we do it

We like to do our budget in a certain way. It provides full visibility and clarity on each aspect of our finances as well as what we have left over to invest.

We follow the ‘use what you need and invest the rest philosophy. This is easier said than done I will add. You have to really be diligent, especially in these interesting times. Paying 7% more for an avocado certainly isn't my idea of fun. I digress.

My wife or personal finance minister is in charge of the money coming in. She has skillfully assigned every dollar to its rightful place. We have a discussion every so often to see if certain expenses need adjusting and we make the necessary changes.

I look after the investments. Where they go, how we are tracking etc. I take what is put in our ‘to be invested’ account and put it into Sharesies every month.

A thing that has always annoyed me was that they were separate. My wife saw money leave the account and she is often surprised at how much we’ve accumulated.

I was frustrated at how separated our two worlds were, so I did something about it.

Something cool

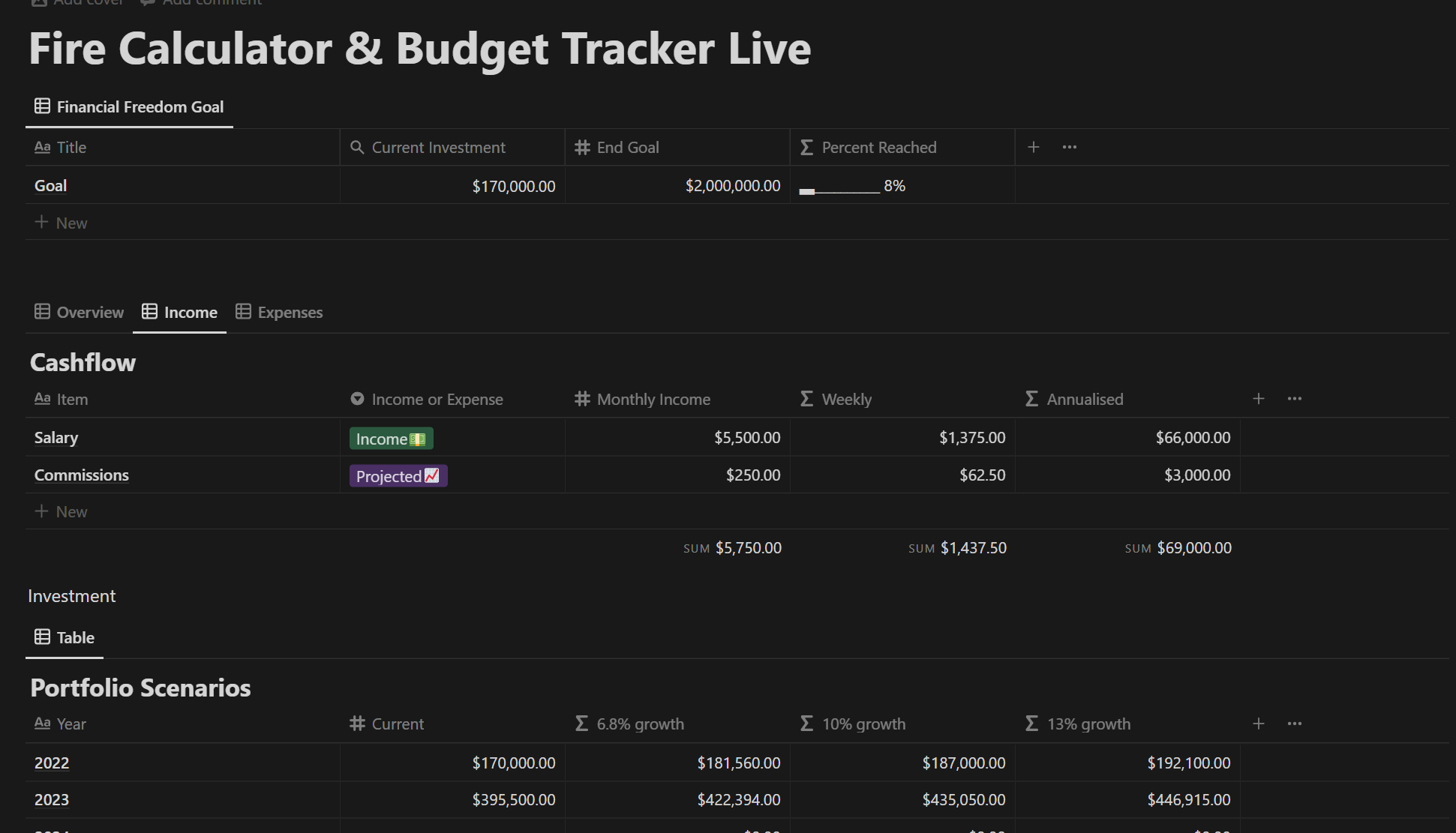

I’ve been working on a project for a couple of weeks. I’ve been working on a budget tracker, but also a way to see into the future and plan what our numbers would look like in a year, two or three from now.

A one-stop shop to see an overview of your current financial situation if you will.

The main goals of the budget tracker were the following :

- Easy to use

- Provide a way to future plan with regards to investments

- Looks good!

And so I am happy to announce that I am in the final stages of completing the tracker. Below you can see a quick preview of what it would look like.

I’m working through the final stages. I am also working on a nice and easy-to-follow tutorial that you can use to ensure you know how to use the tracker once it is released.

If you want to stay up to date and know when it releases, sign up for our monthly newsletter down below.

That's all for this month.

Stay safe

MK