Can you get Rich on being average?

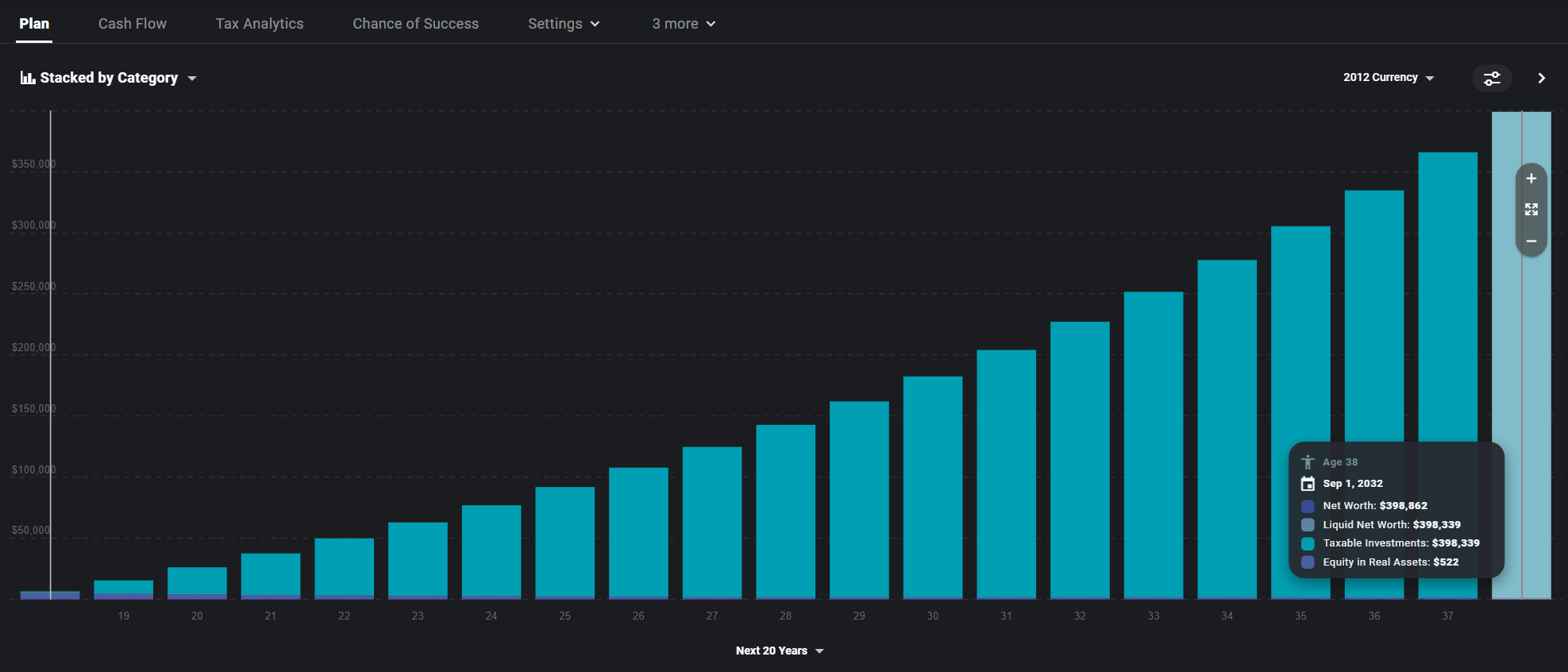

The short answer - is YES. I say yes as rich or wealthy from a purely monetary term could mean a lot of things to a lot of people. However I am looking at a very simple example today. Shoutouts to Projectionlab for making this possible in a few clicks. I wanted to practically show you how someone earning exactly the median for both income and expenses could ‘retire’ before they were 50, starting at age 18.

To some of you, that sounds amazing, to others that might be a long time. What it does prove is that everyone earning the median salary in NZ can become financially independent. As you will see shortly, the longer the timeline goes the wealthier (Bob) our participant gets. I’m sure long-time readers will already know but we love compound interest around these parts.

Set the scene

Bob is a young go-getter right out of college. He has landed an internship as a plumber and is keen to get into this investing thing. He’s landed himself a good job at a company that pays their interns well.

Bob is highly motivated to invest every last cent he needs over and above his current expenses.

How did Bob become financially independent?

Assumptions and constraints

Creating a custom scenario like we are about to do, always has constraints and assumptions. I used both the median wage and median expenses for a single person in Auckland. I think this is actually a conservative estimate as Bob’s income only rises by 3% inflation per year. I’ve also set it so his expenses rise with inflation.

I wanted to showcase a simple scenario to make it practical. Everyone’s scenario and circumstances are different.

Here are the assumptions I made in the below scenario :

- Inflation and income raise by 3% per year. (Realistically Bob would most likely earn a lot more over his tenure at XYZ Plumbers.)

- He starts investing immediately around 18 years of age.

- He starts with $500 in savings and a 5k car. They were his 18th birthday presents

- His financial independence number is equel to x 25 his expenses. This is a rough estimate in the FIRE community as to what you will need to live passively off of your portfolio. Again this is fair in my opinion because although his expenses will rise with a child, a home etc his earnings would also rise. So to keep it simple that is the goal.

- His portfolio grows 6.8% per year adjusted for inflation.

The Results

Let’s take a look at the results.

Start

10 Years

20 Years

Full Plan

Summary

Firstly, how clean are the user interface and graphs… wow. Love me a good graph. The first 10 years showcase good growth and anyone being 28 will be happy with around 142k invested.

After 20 years you can really start to see compound interest doing its work. At age 38 Bob would be looking at a whopping 389k (rounded down) invested.

Finally, if you draw the results out to the overall plan, you can see that after 32 years of earning the same income adjusted for inflation as stated above, Bob has reached FIRE.

I’m not sure about you but even with these very conservative numbers that has to be encouraging. Bear in mind, Bob started from $0 invested…

My Thoughts

Well, it is pretty encouraging to see someone earning a very conservative amount over a period of time and they can retire before turning 50… If you say that to the average Joe or Joet out there, they might not believe you.

These numbers don’t lie… There are thousands of people who have followed these steps and have made this a reality. A hear some people warn me that investing is risky and you can’t predict the market etc. I would argue that not investing is more risky.

This tool truly is an amazing way to create and replicate your specific scenario. Add in kids, cars a promotions. The world is your oyster.

I love that young Bob can now live a more meaningful life. A life not governed by corporate dogma and meetings at 8 Am. He can explore his hobby of carving ice sculptures of mythical birds. Yes that is what Bob is into.

Get your results

Hey, if you thought this was cool or insightful and you wanted your own results, just send me an email telling me you are interested. I'll send you back a few questions and I will be able to run your numbers through these projections just like I did for Bob.

Don’t worry these numbers won’t go anywhere and I will keep them completely private. You can reach me at milan@firelife.co.nz

Final thoughts

Thanks as always for the support. I love writing these and seeing people get involved in the FIRE community. Keep going!

All the best, till next time.

Milan