Investing when the market is down

Let's not sugarcoat it, folks, the markets over the past month could best be described as an angry tiger that hasn't been fed for months. This same tiger is looking to chomp on any market gains made in 2021. That analogy works right? Let's take a look at what has been happening, but more importantly how you can take advantage of this. The downturn does not necessarily have to be a bad thing.,

The current state of affairs

From the wonderful analogy that I used above, you hopefully realise that the markets across the board from equities to crypto are suffering. The forums that I am on are full of questions like "what happened to company x" and "it feels like every time I put money into a company, they lose money" etc. People across New Zealand and the globe are feeling the effect of the uncertainty in the markets.

A classic and tragic example of this would be Robinhood. The stock lost 12% of its value last Thursday as it reported below-par earnings for the quarter. The Shareholders were understandably upset and the stock tanked. The company had lost 85% of its stock value since August... ouch.

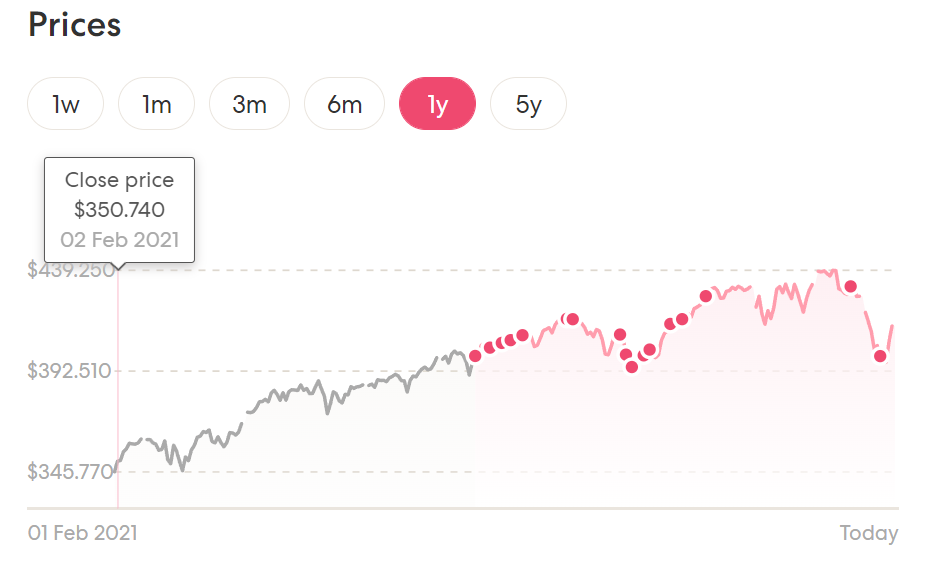

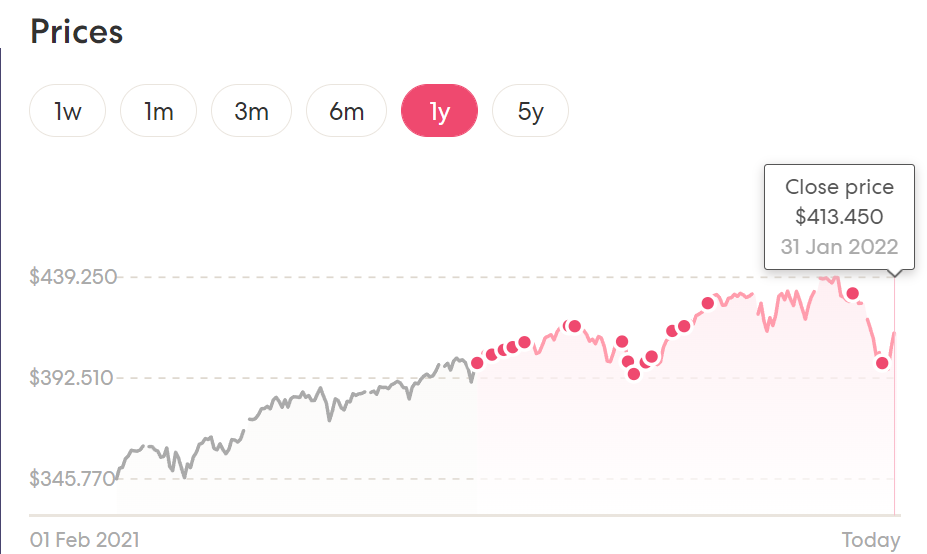

Prices in August 2021 VS January 2022

I have no opinion on Robinhood used in the example, however, they are one in a long string of companies that are feeling the pinch. Now your next question is going to be, why is this happening? I believe it is a combination of factors, inflation being a very large contributor to the hysteria and panic.

On another note, the crypto markets are even crazier with the top cryptocurrencies losing vast amounts of their value Bitcoin's value dropped as low as $33,000 in January from a record of almost $69,000 just three months prior. Crypto's second-largest token Ether has dropped about 30% since December.

People are scared and understandably so. This I suppose leads nicely to the next question. What should I do with my portfolio? Should I also be taking my money out?

Should you pull your money out?

Depending on how long you've been an investor, market downturns (a fancy way for saying equities or stocks are losing their value) do one of two things. They excite or scare you. From what I've seen, the less experienced investor will invest and pull out their money upon hearing bad news. They would easily pull out their money as soon as they see some money being lost. Similarly, they will pile in as much cash as possible when they think the market might be going up.

The long and short of all of this, who cares what the markets are doing? I log in a couple of times a week to my account to check what's been happening, but I follow almost no news on specific stocks like Robinhood etc. My investment strategy is not reliant on a couple of companies performing, but rather the average of 500 companies winning.

This particular strategy allows me to sleep easily at night as I am confident that over the next decade, we as a family will be better off. To answer the above question, NO we will not be taking out a single cent. In fact, we will be investing as much as we can over the next time because at this stage we know that a market correction means we are saving days/weeks/months at the end of our FIRE journey. This is why it is so important to have an investing strategy that allows you to win in both the upswings and downswings in the long term.

You can easily follow along with what I do in this Free workbook/course where I dive deep into getting started with investing.

Ride the wave and win

It was around March last year when there was a massive panic about the markets turning and people jumping out of their investments. Similarly to what is happening now. In the short term, yes you might experience losses and yes the road might seem bumpy, especially when you pass the three, four, five or even six-figure mark. It is important to keep in mind that over the long term with a strategy like index investing, you will win. Now is not the time to listen to uncle Ben and "run for the hills" or "get out of the market and keep cash on hand".

My favourite quote of all time which I've added in before is by the oracle himself :

- Warren Buffet

To show you a practical example of what I mean by riding the wave, I will post a graph indicating the S&P 500 and when we invested over the year. We've never tried to time the market or sold our shares (Aside from milestone money)

The point I am trying to make is, that even though we sometimes invested right before a correction, over the long run we are still ahead. I've lost 0 nights sleep over worrying about my portfolio! I would encourage you to adopt a similar strategy if you haven't already.

Final word

That's going to do it for this months post folks! Excited to get back in to writing the bi-weekly newsletter, so be sure to sign up for that down below if you haven't already. As always feel free to email me at milan@firelife.co.nz if you would like a question answered or DM us on Instagram.