Investing to become a millionaire

Money, cash, cheddar, dinheiro, geld. The thing that drives most societies these days. The thing that drives us? This title isn’t click bait. No today I will show you how should be investing to become a millionaire.

Money is a funny thing in my opinion. Most people view money as the only thing to strive for. The ‘end game’ as such.

“I think everybody should get rich and famous and do everything they ever dreamed of so they can see that it’s not the answer.”

Jim Carrey

Having enough money gives us choice. That in my opinion should be the real end goal. The ability to choose what you do with your time is a luxury most people will never have. That is exactly why we are aiming to achieve FIRE

Achieving FIRE doesn’t mean that we will sit on a coach and try to watch every show on Netflix. FIRE for us means we have time to spend our soon to enter the world daughter, follow any passion we can think of. Finally do that thing you have always wanted to do.

I bring this to light as the road to FIRE is a bumpy one. This goes hand in hand with investing to become a millionaire.

What does a millionaire look like?

Enough dilly dally, how do you invest like a millionaire Milan? Lets look at some statistics first (fun right). A survey in America found that roughly 80% of millionaires in the US are first generation millionaires. Meaning these people were not born in to wealth, no trust funds for these babies.

Simply put the vast majority of millionaires are people who have the following traits :

- They are money literate

- They invest in real assets

- They live within their means

My favorite book of all time ‘The Millionaire next door’ explores the above statements in depth and uncovers why millionaires are well… millionaires. The book is centered around a massive survey done across the US to study and find out what the difference is between an average Joe or Joet and a millionaire. Seriously this is a must read for anyone wanting to improve their personal finances.

To summarize the book found that what the world perceived to be a millionaire vs what a millionaire actually was, was completely different.

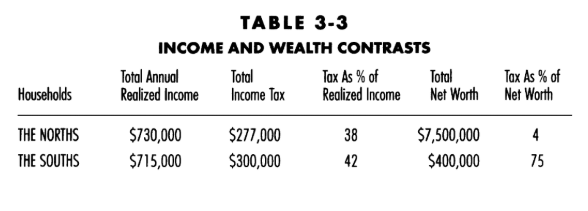

One of the prime examples they use was 2 doctors. Dr North and Dr South who both earned upwards of $700 000 USD. By any definition this is a large income amount. (Bear in mind this study was done years ago so this salary would be even more today.)

See investing to be a millionaire isn’t difficult. Just like losing weight is simple in theory. Eat less and train more. The execution is what most people fail at. Why is that?

Why people fail at investing.

Consumerism. That is it. The book explores this theory and comes to a similar conclusion. See before I went down the path of learning to invest I was well on my way to lead a traditional life. Work for 40 – 50 years, buy the most expensive house I could afford with a 30 year mortgage, buy 2 cars and lease new ones every few years, the classic ‘Kiwi dream’.

I say HELL NAW to that. How boring. Most people fail because they are in the same mindset and it isn’t their fault. We are conditioned from birth to spend.

See consumerism makes the the ‘economic wheels turn as such. We are conditioned to buy buy buy. As soon as you get a raise what is your first instinct? Is it to save it and invest it or is it ‘lets buy those new shoes I’ve always wanted, I deserve them right?’

This mindset WILL keep anyone thinking like this broke and they are money illiterate.

How can we be different?

To combat the rampant disease that is extreme consumerism and start investing to be a millionaire we must look inward first.

What do I mean by that? After reading quite a few books on personal finance you see patterns and things that work. I honestly believe that the first step in becoming a millionaire is to get your budget in order. That means no more impulse buys, not more spending as much as you earn.

Practical steps to a better budget :

- Write down how much you earn

- Write down every single expense that you know of

- Find the ‘loose change’ (money you can start saving or investing)

- Write down and separate wants from needs

- Start investing/saving the rest.

Notice how I said ‘write’ down. It is important that this is an exercise done by writing or doing. Doing this forces you to face reality. this act alone will put you ahead of most.

Make sure this is an honest exercise. I would even suggest you do it with a trusted friend or family member to keep you accountable should things not go your way.

‘Find the loose change’ – This is the money leftover after everything has been paid. You might be surprised to see how much money you actually have left over. This money is the money that you start investing or saving.

Needs not wants – Paying rent is a need. Buying a Nintendo Switch is a want. Every single person in the above study was remarkably frugal and saved a lot more money than they spent.

Investing/saving the rest – This is the fun part. This is where you take all the leftover change and you start accumulating it. Investing can be tricky to navigate and with so many differing opinions out there you must find what works for you. Thats why I created my own investing course.

A different type of investing strategy

I was hesitant at first to when I was thinking of creating an investment course. As I mentioned above, the world of investing much like consumerism is motivated by a multi billion dollar industry to confuse people.

Big words like arbitrage, averaging down , bear market etc etc are thrown in to news reports to show you that the people looking after the money are ‘very intelligent’.

No doubt there are some extremely intelligent money managers out there but the more they can convince you that investing is ‘too complex’ the easier it is for you hand over your hard earned cash to them.

I created this course with a single purpose. To show every person out there even if you haven’t invested in your entire life, that you don’t have to be scared. In fact it is actually really simple like the losing weight example up above. Here is the link again if you would be interested.

Course Overview :

13 Page downloadable PDFWe’ve covered a lot in today’s post. Hopefully the advice assists you in your journey.

A great experience

I was recently invited to host a webinar with my friend Sam over on his blog The Comic accountant

This was honestly so much fun and one of the listeners had this to say

“I really liked your interaction together. What I liked best about the advice was its simplicity”

If you were interested you can find the webinar here.

Thanks again Sam I am sure we will interact in the future. Make sure to show him some love over at his blog. .

Life update

As the day of my daughters birth draws near I am both excited an nervous. I seriously can’t wait to teach my daughter all about life and to spend as much time as possible with her. I will definitely be making a post on how I will be investing for my children.

I am so glad I started this blog when I did because I want to show people exactly what I am doing to achieve FIRE. We are having a child, and yes there are a lot of things to consider (nappies mostly).

That being said this won’t stop us from investing at all. Our dream of FIRE is not only alive and well it drives us to try and achieve it faster so we can spend more time with our daughter.

We’ve covered a lot in todays post, I really do hope that it helps you on your journey. I would love to hear your stories, please send me how this post has helped you budget better or what some of the things are you are using to help you along your FIRE journey. Email me at milan@firelife.co.nz I would love to hear from you.

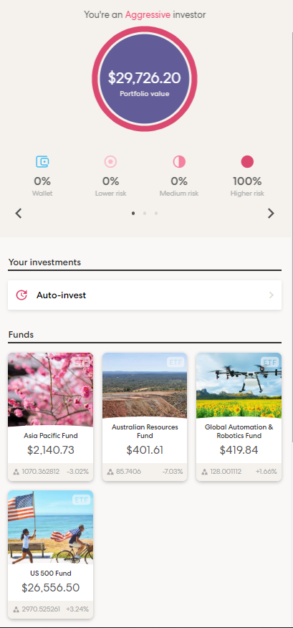

My portfolio

As always here is my portfolio.

Thats it for the last couple of weeks folks.Hey did you want to know more about investing? I will be sending you some awesome investing advice via email if you sign up to the subscriber list on the right.

Be Blessed

Peace

MK

Also please sign up for the newsletter if you haven’t already. I will share some helpful tips and thoughts with you every other week.

- Our portfolio.

- Our monthly budget breakdown.

- My monthly book review.

- Investor scenarios, where I share conversations I am having with people around FIRE and investing.

- Future things! I will aim to add more valuable things here in the future.

This also includes our completely free workbook! Where I will show you what I do to invest.