Investing Milestones

Its been a hot minute since I wrote my last blog post. I’ve been pondering how I can improve the blog and ensure that everyone who reads it can walk away with some new knowledge around investing or personal finance. Any suggestions welcome btw. Send me an email email hyperlink about how to improve or to share some of your stories. I’d love to start featuring reader stories and journey’s on the blog to encourage anyone that is doing this to dive in headfirst and go for it.

Why we have investing milestones

Today marks the day I write about our first milestone achievement and what it means for our FIRE journey. See when I initially got excited about becoming financially independent and retiring early, my wife did not read the same books I did. So I had to convince my wonderful wife that we are going to start living off of a single paycheck and invest around 50% of our income…

Lucky for me I married a forward-thinking woman who understands the value of time freedom. She almost immediately got on board as soon as I pitched the idea. But don’t let me put words in her mouth, I asked her if she was willing to answer a couple of quick questions as to why this journey was important to her. Over to Mrs Firelife :

Q1. What were your initial thoughts when I asked you to drastically reduce our spending and invest about 50% of the money we make?

I am and have always been one that loves to watch my savings account grow, seeing the number get higher and higher every week was just the best thing ever. So when Milan initially asked me to start investing, everything we put into savings, I almost had a heart attack. In my head that was like taking away the pleasure of seeing the number grow in the bank. I was emotional because I felt we were losing that money. I didn’t understand that it was actually going to make that number grow a lot more, it was just in a slightly different place. Once I got my head around investing I was excited about it and cutting down our budget was a challenge that I embraced and loved. I love spending money, but I think I love watching our investment portfolio grow even more (something I never thought I would say). If I could give you one tip in this investment journey, and I am sure Milan will agree, reward yourself! Set goals and reward yourself when you have reached those goals, you deserve it!

Q2. What do you think will be the outcome us investing and saving for an early ‘retirement’

This one is easy. Time is money and the more we sacrifice now the more time we will have in the future. Imagine being able to spend all your time on the things that you love without worrying about money. Of course, we would love to have more than enough money-wise, but that is not our goal. Our goal is to have enough to spend days with our family, pursue hobbies and dreams without our time being eaten by a medial 9-5 job. Wow, Milan has indoctrinated me, but there is truly nothing as important as time!

How do investing milestones work?

Well, I am glad you asked. We decided on a simple reward system that would not only incentivise us but drive us to try to invest as often as possible. We agreed on 5k as a good amount to take out after every 50k invested. At the start naturally, you are taking out 10% of your investment, so seems like a lot. Remember that the next milestone will only be at 100k, and that is only 5% of our portfolio. The percentage becomes less over time.

Now you can definitely make the argument for why aren’t we just keeping the money invested? Well I’ve found that this journey is a long one. Even though we are doing better than we expected, this is a long windy road in which only the most disciplined will see the end.

A little pick me up or reward money after investing diligently for a couple of years is just what the doctor ordered.

I am not saying investing milestones will work for everyone, and if you want to leave all your money invested in order to get there faster, more power to ya!

What did we spend our milestone money on?

This is the fun part! Well we decided to split this round of our investing milestone right down the middle (2.5k each) so we can buy some things we really want. My wife really wanted a Macbook and I really wanted a new cricket bat.

Sowe got our things. I’ve actually left the majority of my milestone money invested as I will be looking to upgrade my PC parts in the near future (yes I am a nerd)

We are super happy and grateful that we are in such a good position to be able to do these things. We have however spent quite some time diligently investing, so the few goodies we buy, we buy them guilt-free!

I would suggest that you look at doing something similar as we got so excited when our first milestone was approaching. We were scrounging and trying to find every single cent to invest so we can take our milestone out and get some ‘retail therapy’ as they say.

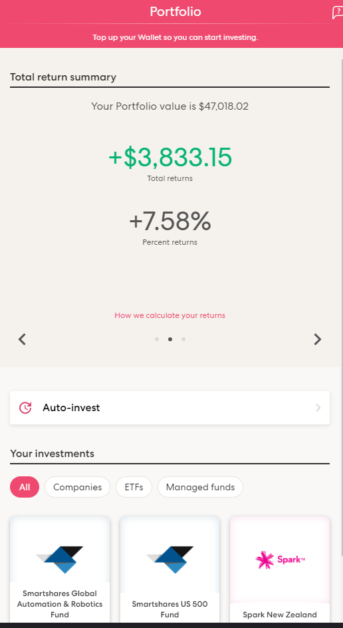

Our portfolio

Today I will show you our pre and post investing milestone portfolio. On a side note, I am very happy with the recent news that Tesla is joining the S&P 500 index. This will mean we are adding another winner to our index in my opinion!

Pre Milestone

Post Milestone

Thats going to do it for this one. As I mentioned up above I would love to hear from people on a similar journey. Send me an email with your stories and how you are doing this journey.

Stay safe.

MK

Also please sign up for the newsletter if you haven’t already. I will share some helpful tips and thoughts with you every other week.

- Our portfolio.

- Our monthly budget breakdown.

- My monthly book review.

- Investor scenarios, where I share conversations I am having with people around FIRE and investing.

- Future things! I will aim to add more valuable things here in the future.

This also includes our completely free workbook! Where I will show you what I do to invest.